As the margin long-to-shorts ratio for Bitcoin reaches a record $2.5 billion, leverage for the cryptocurrency will increase

BTC traders at Bitfinex and OKX have been reluctant to use margin markets for bearish bets, creating an imbalance that investors should keep an eye on.

Cryptocurrency traders’ desire to create leverage positions with Bitcoin is strong, but it’s impossible to know if these traders are risk-takers or savvy market makers who hedge their positions. The need to maintain hedges holds even if traders rely on leverage merely to reduce their counterparty exposure by maintaining a collateral deposit and the bulk of their position on cold wallets.

Not all leverage is reckless

Whatever the motivation behind traders’ use of leverage, there is currently a very unusual imbalance in the margin lending markets that benefits BTC longs who are anticipating a price increase. Despite this, the BTC futures markets remained largely stable throughout 2023, which has limited movement so far on margin markets.

Futures contracts and margin markets function differently in two key ways. Since those contracts are not derivatives, trading takes place on the same order book as standard spot trading and, unlike with futures contracts, the balance between margin longs and shorts is not always equal.

For instance, one can actually withdraw the coins from the exchange after using margin to purchase 20 Bitcoin. For the trade, there must of course be some kind of collateral or margin deposit, and this is typically based on stablecoins. The exchange will automatically liquidate the margin to pay the lender if the borrower fails to close the position.

A rate of interest must also be paid by the borrower for the BTC purchased with margin. Markets run by centralized and decentralized exchanges will have different operational procedures, but typically the lender controls the rate and length of the offers.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

Trades on margin can be long or short

By borrowing stablecoins and using the money to purchase additional cryptocurrencies, investors can leverage their positions through margin trading. These traders bet on a decline in price when they borrow Bitcoin and use the currency as collateral for short positions.

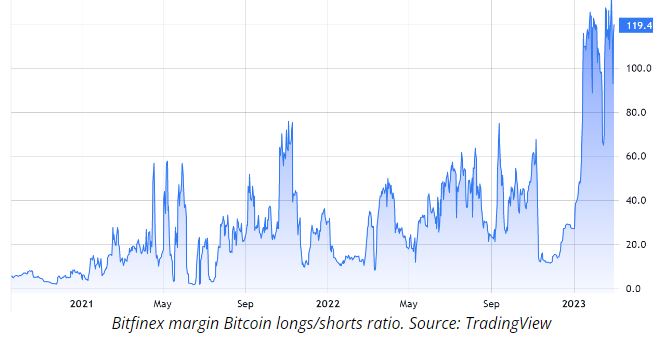

For this reason, analysts track the total amount of lending for Bitcoin and stablecoins to determine whether investor sentiment is bullish or bearish. It’s interesting to note that on February 26, margin traders on Bitfinex entered their highest leverage long/short ratio.

The creation of margin positions of 10,000 BTC or higher by Bitfinex margin traders is a historical practice that has been linked to the involvement of whales and sizable arbitrage desks.

According to the above chart, on February 26, at 105,300 BTC, the long (bulls) margin demand outpaced the shorts (bears) by a factor of 133. The last time this indicator hit an all-time high in favor of longs before 2023 was on September 12, 2022. Unfortunately for bulls, bears benefited from the outcome as Bitcoin fell 19% over the next six days.

Since each market has a unique set of risks, norms, liquidity requirements, and availability, traders should cross-reference the data with information from other exchanges to make sure the anomaly is widespread.

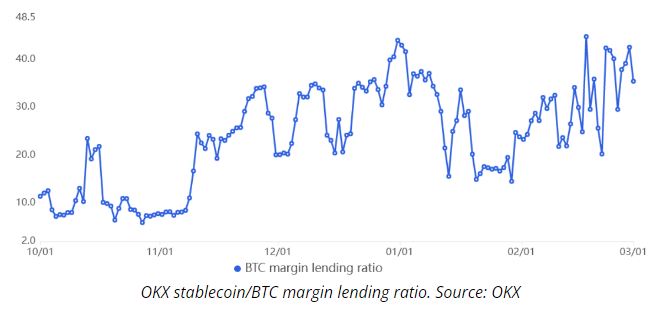

For instance, based on the stablecoin/BTC ratio, OKX offers a margin lending indicator. By taking out loans to purchase Bitcoin with stablecoins on OKX, traders can increase exposure. Borrowers of Bitcoin, on the other hand, can only wager on a cryptocurrency’s price falling.

The above chart indicates that OKX traders’ margin lending ratio increased throughout the month of February, indicating that they added leveraged long positions even though the price of bitcoin repeatedly failed to break the $25,000 resistance between February 16 and February 23.

Furthermore, on February 22, the margin ratio at OKX reached its highest level in more than six months. This level is very out of the ordinary and is consistent with the trend at Bitfinex, where a significant imbalance favored Bitcoin margin longs.

The imbalance may be explained by the variation in the cost of leverage

Throughout 2023, Bitfinex’s leverage BTC longs rate was virtually nonexistent, currently sitting at less than 0.1% annually. In other words, traders shouldn’t panic because the cost of margin lending is still in a healthy range and the imbalance is not present in markets for futures contracts.

The movement, which did not occur over night, might have a tenable explanation. For instance, the increasing cost of stablecoin lending may be to blame.

Borrowers of stablecoins on Bitfinex pay 25% annually instead of the lowest rate offered for Bitcoin loans. When the top derivatives exchange FTX and their market maker, Alameda Research, blew up in November 2022, that cost rose dramatically.

Traders should keep an eye on the data for new indications of stress as long as Bitcoin margin markets are extremely unbalanced. There are currently no warning signs, but the size of the Bitfinex BTC/USD longs ($2.5 billion position) should raise red flags.