Dopex Analysis: The first and only options exchange on Aribitrum with useful features

Derivatives always have a higher trading volume than crypto market spots due to leverage and hedging. However, derivative goods flourish and account for significant trade volumes on centralized exchanges (CEX).

Decentralized exchanges (DEXs) continue to face a number of obstacles, including fluctuating gas costs, low liquidity, the possibility of liquidation, and the low number of blockchain-based transactions. focuses on the exploitation of derivative goods in projects. DeFi’s derivatives market, as a result, is still in its infancy but has tremendous potential.

The entire crypto industry is working extremely hard to develop option, which is regarded as one of the essential components of derivatives. One of the highest derivatives investments is made by Arbitrum.

What is Dopex?

Dopex is a decentralized options protocol based on Arbitrum. The crypto community will benefit from liquidity provided by the project. Additionally, Option buyers can benefit from Dopex’s ability to reduce risks and increase profit efficiency. Participants are able to provide more advantageous liquidity thanks to this function.

Dopex offers many different options groups. Consequently, anyone can sign up, deposit, quote, and earn passive income. The option’s creation or purchase from the Liquidity Pools will determine the amount earned. Especially with Dopex, users may earn money right away.

On Dopex, option pools have been created for all of the options. Anyone can join and deposit or quote into their respective pools to make a quick profit by writing options and buying options at a discount through liquidity pools.

DPX, a token for limited supply management, will be used by users to control the protocol and collect fees for the application layer and protocol itself.

Dopex also provides a plan to reimburse option writers for losses incurred on the basis of executed options across all epochs. The rDPX tokens that are distributed as refunds have an infinite supply.

What’s so special about Dopex?

Investors can trade safely and reduce the biggest risk with Dopex. It can be used by users without putting DXP customers’ interests at risk.

- Fair prices for options: The Dopex model makes it possible for a more realistic and equitable decentralized option chain in terms of price.

- By allowing customers to buy and sell options at any actual price, deeper liquidity is achieved.

- Liquidity providers can use the rDPX discount code to balance risk and cut losses.

- Discount options that provide quick arbitrage opportunities enable price efficiency.

- Profit Continually: Users may be compensated with DPX governance tokens for providing liquidity to particular pools.

- Complete the loan: Pre-existing collateral is included in all Dopex alternatives to keep you covered and prevent third-party default.

- rDPX can be used as collateral to create fake assets such as stocks and indices.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

How does it work?

The goal of the DopeX team’s Single Staking Options Vaults (SSOVs) is to ensure that option buyers have access to ample liquidity and fair pricing while option authors minimize their losses. The SSOV will rule for a month. The author of the option can deposit the asset, select a strike price, and then sell it to the call option at a predetermined price before the option expires.

It is simple to comprehend as follows: The client deposits one BTC into SSOV at the current BTC price of $28,000. The user’s assets will then be locked until the cycle is over, which should take about a month. This user can create a call option contract using the smart contract and wait for the contract’s execution date. For instance:

- The customer will receive one bitcoin and make a profit from selling the call option if the price of bitcoin falls to $28,000.

- The buyer will lose the difference between the $28,000 price and the call bonus amount if the BTC price is higher than $28,000.

As a result, in addition to offering derivative products comparable to those found on centralized exchanges, Dopex enables customers to generate extra income by staking and trading options. This will assist users in optimizing their capital.

Features

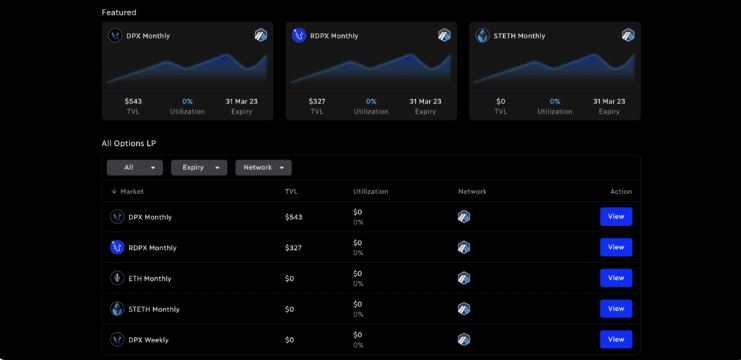

Option pools

Dopex distributes risk and optimizes liquidity by selling options to all liquidity providers. Instead of the time-consuming trade-in process, the proposal makes direct choices.

By participating in the option pool, each user may gain: As a reward, users will receive earnings every quarter, such as premium DPX reward tokens. Somewhat to upgrade convention liquidity.

Dopex has also built volume pools to encourage the adoption of protocols and participation in option pools. The discount of 5% on option (buy) transactions is intended to increase volume.

Naturally, those who contribute to this pool will receive DPX bonus tokens early on to encourage usage; Users can withdraw their assets at any time or continue participating each quarter. However, you will be assessed a penalty cost of approximately 1% if you withdraw funds but do not use them.

Option pricing model

The Black-Scholes equation is used by Dopex to determine the price of options. However, in contrast to previous protocols, the project ensures that all strike options are properly considered.

This strategy is carried out with the help of dopex delegates. In order to imitate genuine supply and demand and fair pricing, individuals chosen to represent DPX will regularly submit option price coefficients.

This gives sellers and buyers a reasonable price range to choose from. At first, these delegates consisted of five of the most prominent derivative traders in the cryptocurrency industry.

Reimbursements in the event of a loss through rDPX

in the case of an options group that loses money over an extended period of time. rDPX, the discount token for the Dopex protocol, will be made available. In US dollars, the reimbursement is calculated as a percentage of the option writer’s loss.

The goal of this strategy is to protect members of the option pool from losses. After that, the player can rest assured of a greater profit than if they had written naked options.

Rewards

Dopex will essentially offer two types of user incentives: Rewards for actions and function calls.

Function call rewards

This is the most popular reward in the ecosystem. Users will receive this incentive in exchange for burn fees in specific essential processes.

On the ecosystem, this is the most popular reward. This incentive will be distributed to users in exchange for burn fees in certain essential processes.

Action rewards

Action awards are given for liquidity contributions to the Option Pool or Volume Pool.

The fact that the platform stores the fees it earns in a private repository is one of the most intriguing aspects of Dopex. The user’s DPX currency staking is supported by this source of cash. Clients will get income from the capacity on the off chance that they stake DPX. The funds can be exchanged or put to use in deals on the Dopex platform.

rDPX token

Similar to SLP tokens, rDPX’s endless supply necessitates farming and dumping. It does, nonetheless, have limited outflows. This is because it is solely derived from the options writer’s liquidity gains and losses.

The following are applications of rDPX:

Future application layer additions to Dopex (such as vault) will necessitate a fee for staking rDPX.

rDPX will get collateral from Dopex.

In the mining of synthetic assets, rDPX is used as collateral.

Writing strategies will be utilized all through the protocol to exert deflationary pressure on rDPX.

Increasing staking rewards and using rDPX as fees can put a lot of pressure on the market. The protocol manages the collateralization rate to encourage the use of rDPX rather than DPX, despite the fact that DPX can also mint synthetic assets. In addition, in order to guarantee rDPX’s long-term viability, the protocol is now recommending a v2 model.

veDPX token

DPX (veDPX) must be frozen for a certain amount of time before the governance token can be obtained. Under this governance, users can vote. Due to the fact that it dictates gauge weights to pools, which determine the quantity of emissions that particular pools receive, voting power will be crucial to the operation of the Dopex platform.

Dopex intends to use this strategy in the same way that Curve provides deeper liquidity for specific pools for specific SSOVs.

veDPX holders may likewise decide on strikes for our SSOV choices, strikes for IRO choices, V2 boundaries, and other Dopex-explicit issues.

There will be the option to lock DPX for up to four years, and lockers will receive veDPX proportional to the lock’s duration; the longer the lock, the more veDPX users will receive. People who lock for a longer period of time will have more control over the distribution of Dopex liquidity because veDPX is the governance token.

In addition, holders of veDPX receive increased pool prizes and platform fees. Similar to veCRV, veDPX will deplete over time as unlock strategies ensure that holders with long-term commitments to Dopex have a greater influence over governance.