Although the hash rate of bitcoin is increasing, DeFi is in danger: Report

The mining sector is evolving thanks to new hardware, but other cryptocurrency sectors are still struggling.

The beginning of 2023 gave rise to expectations that the blockchain industry was headed toward recovery, but weaker-than-anticipated financial results and a wave of bad news in February have raised questions about this outlook. However, not every industry sector is equally impacted by these headwinds. The market as a whole is still cautious, but nonfungible tokens (NFTs) and security tokens have been able to isolate themselves from the external environment and demonstrated success in February.

For those who are serious about learning about the various sectors in the crypto space, Cointelegraph Research publishes a monthly Investors Insights report that delves into venture capital, derivatives, decentralized finance (DeFi), regulation, and much more. The monthly reports, compiled by top authorities on these different subjects, are a priceless resource for quickly gaining an understanding of the state of the blockchain market today.

Is financial consolidation possible for the mining sector?

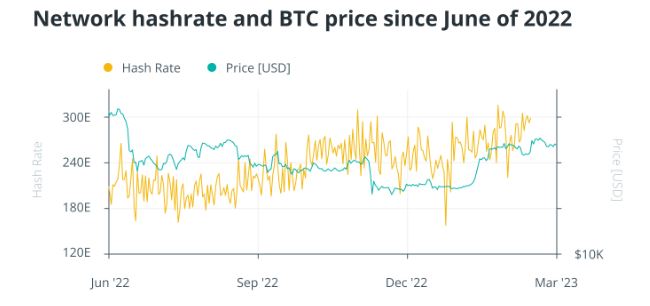

Numerous news stories about struggling miners have surfaced during the bear market, particularly those involving publicly traded U.S. mining companies with high debt loads that suffered as a result of falling Bitcoin prices. However, according to data from Hashrate Index, the introduction of new, highly effective mining hardware in 2022, such as Bitmain’s Antminer S19 Pro and S19 XP and Microbt’s WhatsMiner M53, has led to efficiency gains of up to 30%. Investors were alerted to the introduction of this new hardware by Cointelegraph Research’s August 2022 trends report, which also predicted that the hash rate of the Bitcoin network would increase as a result.

Despite the bearish market conditions, which typically result in a drop, the hash rate has in fact continued to reach new all-time highs since August. 44,000 Antminer S19j Pro miners have been purchased by Iris Energy, and CleanSpark has also added 20,000 S19j Pro+ miners to its inventory. This is in spite of Iris Energy having missed payments on its debt back in November.

In the mining industry, it’s crucial to stay ahead of the rest of the network. Before the problem catches up again, those who are able to raise money and acquire new electricity-saving hardware before others will be able to realize sizable profits. There may be hope for miners who are able to raise this money.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

regulatory pressure on the DeFi sector is increasing

The DeFi sector’s pillars are under threat as regulators intensify their enforcement efforts. On February 12, it was made public that Paxos, a significant stablecoin issuer, was the target of a crackdown by the Securities and Exchange Commission. The SEC informed Paxos via a Wells notice that it intended to sue the company for selling unregistered securities; the security in question was specifically identified as Binance USD. Following the notice, BUSD saw a decline in market capitalization of more than 40%.

This crackdown poses a serious threat to the stablecoin market because it offers traders secure ways to take profits. Many are concerned that these actions will spread and that Paxos won’t be the only target. Given that there are no obvious expectations of profit from stablecoins, the SEC’s classification of them as securities is unexpected.

Whether the SEC will take similar action against Tether and its USDT stablecoin, which is allegedly being used by North Korea and Venezuela to evade sanctions, remains to be seen in light of the SEC’s recent action. The Regulation and DeFi sections of Cointelegraph Research’s Investor Insights Report this month contain additional significant developments in this field.