Breaking: Silicon Valley Bank has $3.3 billion tied to Circle

Circle urged the continuation of SVB in the US economy along with other clients and depositors.

On March 10, USD Coin USDC and a blockchain payment technology company

tickers $0.89 down

Issuers Circle confirmed that $3.3 billion of its $40 billion USDC reserves are still held at Silicon Valley Bank (SVB) as a result of wires that were initiated on Thursday to remove balances that had not yet been processed.

Due to Circle disclosing in its most recent audit that as of January 31, $8.6 billion, or roughly 20% of its reserves, was held up in several financial institutions, including the recently bankrupt Silvergate and shuttered SVB, worries about USDC have been growing as of late this week.

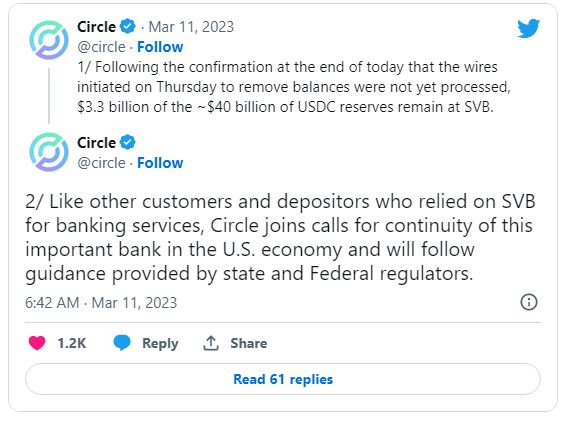

In an effort to be transparent, Circle stated the following on March 10 via Twitter:

“Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.”

Circle asserted that it has joined other clients and depositors in urging SVB to remain operational, claiming that this is crucial for the health of the American economy. Circle announced on Twitter that it will abide by the instructions given by local, state, and federal regulators.

The company’s chief strategy officer and head of global policy emphasized, in addition to what Circle had already said, that “Circle is currently protecting USDC from a black swan failure in the U.S. banking system,” while also urging the Federal Deposit Insurance Corporation (FDIC) to implement a SVB rescue plan:

Without a Federal rescue plan – will have broader implications for business, banking and entrepreneurs.

A Circle representative also emphasized that SVB is “one of six banking partners Circle uses for managing approximately 25% of USDC reserves held in cash” in a statement to Cointelegraph. Circle and USDC are still operating normally while we wait for details on how the FDIC’s receivership of SVB will affect its depositors.

Notably, according to CoinGecko data, USDC was trading below its $1 peg at $0.98 prior to the announcement. However, shortly after, the price sharply dropped to $0.93 at the time of writing.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

In the wake of Silicon Valley Bank’s closure by California’s financial watchdog as the first FDIC-insured bank to fail in 2023, the statement was made. Silicon Valley Bank was a major financial institution for venture-backed companies.

The California regulator named the FDIC as the receiver to protect insured deposits, despite the fact that the precise cause of the closure is still unknown. A number of venture capital firms with a focus on cryptocurrencies, including Andreessen Horowitz and Sequoia, received financial services from SVB, one of the 20 largest banks in the United States by total assets.

Coinbase and Binance pause USDC conversions

About 30 minutes after Circle’s most recent statement, Coinbase stated that it is “temporarily pausing USDC:USD conversions over the weekend while banks are closed,” which only serves to compound the problems related to USDC.

“Conversions depend on USD transfers from the banks that clear during regular business hours during times of increased activity. We intend to resume conversions when banks open on Monday, the company said.

A move like this emphasizes the challenges centralized cryptocurrency businesses are now facing since Silvergate is no longer offering them 24/7 banking services.

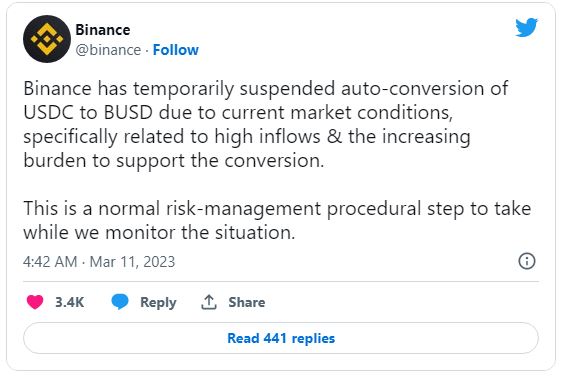

Additionally that day, Binance tweeted that it had “temporarily suspended auto-conversion of USDC to BUSD due to current market conditions, specifically related to high inflows & the increasing burden to support the conversion.”

The company added, “This is a standard risk-management procedure step to take while we monitor the situation.