Raydium: The Best Spot Trading And Liquidity Features For The Solana Ecosystem

Decentralized exchanges and apps created on the scalable blockchain have received more attention in light of Solana’s recent rise to become one of the top seven cryptocurrencies by market size.

In the Solana ecosystem at the time of writing, 350 projects were active. One of these sites that is particularly well-known is Raydium. So let’s get started with our Raydium Review and see if it’s the right platform for you.

Overview of Raydium

On the Solana blockchain, Raydium is an automated market maker (AMM) that makes use of the depth and central order book of Serum, a well-known decentralized exchange built on Solana. It is a crucial part of the Solana ecosystem that uses liquidity pools to facilitate incredibly quick token swaps and transactions.

With a maximum supply of 555 million coins, it was launched on February 21, 2021, by three creative creators, AlphaRay, XRay, and GammaRay.

By routing orders through either a liquidity provider or the Main order book, Raydium differs from other AMMs in that it looks for the best possible rates for token swaps. Additionally, the user interface and experience are both excellent.

Like other decentralized exchanges, Raydium allows users to transfer assets using a liquidity pool method. While Raydium uses the Serum DEX created on Solana to accomplish this. Through the Serum DEX interface, users can gain access to an ecosystem-wide central limit-order book system that, in comparison to other platforms, provides unparalleled liquidity.

Additionally, Raydium has its own cryptocurrency called “RAY,” which grants holders access to the platform’s native launcher called “AcceleRaytor” and a cut of protocol earnings. Future plans call for RAY to serve as a governance token that grants holders potential governance rights. DeFi Llama claims that “Raydium,” which has more than $317 million in assets on its platform, is currently ranked fourth in terms of total TVL within the Solana ecosystem.

In the summer of 2020, the team behind the fictitious developer AlphaRay founded Raydium. When DeFi first launched, experienced trader AlphaRay was looking for a solution to Ethereum’s exorbitant gas costs. He then got in touch with the FTX team and presented his idea to them. The Solana blockchain and the Serum protocol were two projects with which FTX had previously collaborated and engaged AlphaRay.

Raydium, which debuted in February 2021, was developed by AlphaRay and the rest of the Raydium team after they recognized Serum DEX’s potential. The team at Raydium has more than two decades of experience in high-frequency trading, arbitrage, and market making in both cryptocurrency and traditional markets.

AlphaRay is in charge of managing Raydium’s entire strategy, operations, product direction, and commercial expansion. Before switching to creating bitcoin markets and supplying liquidity in 2017, he worked in commodities algorithmic trading.

XRay and GammaRay are two additional well-known team members. The director of marketing and communications is GammaRay. He is in charge of strategy and product development. His experience in cryptocurrency prior to joining Raydium was in marketing and technical analysis.

The Head of Technology and manager of the Development team is XRay. He has nearly eight years of experience in system design, traditional market trading, and cryptocurrency trading. Raydium’s technologies and infrastructure were also created by X.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

Trading features

Trading and Swapping

Customers of Raydium have two exchange options. Either their “Trade” option or just “Swap” will accomplish this.

Users can trade their tokens using “Trade” using an interface resembling a centralized exchange. Thanks to its interaction with serum, users are able to place Limit orders and investigate a variety of markets to trade with.

Any SPL token can be switched between using the easy method “Swap”. Using Raydium’s Best Price Swaps, the system will determine whether swapping within a liquidity pool or through the main order book will offer its customers the best pricing.

There is more liquidity and less slippage for its customers because the liquidity comes from both its own liquidity pools and the Serum order book.

With two significant exceptions—unprecedented liquidity and the ability to place limit orders on particular coins—Raydium’stradingexperience is comparable to that of Ethereum DEXs. Both of these capabilities are made possible by Raydium’s interface with Serum DEX.

If you are unfamiliar with Serum, it is a layer of the DEX protocol that allows developers to build their own DEXs on top of it. This makes it possible for exchanges powered by Serum to use its on-chain central limit order book technology to access and share liquidity.

Limit Order Book

Customers can view the price chart of the desired token pair as well as the highest buy or sell bids made by exchange users on Raydium’s Limit Order Book interface, which provides an experience similar to centralized exchanges.

On some tokens that are accessible through its trading interface, it allows users to place limit orders. Limit orders allow users to specify the price at which their transaction should be executed. This makes it possible for customers to trade with a great deal less stress than they would on the majority of other DeFi exchanges.

Over 260 market pairings are currently actively supported by Raydium’s user interface. But as long as it already has a market on Serum, users can access and add any new market pair that is not shown on the UI.

To add an existing market pair on Serum to Raydium, users must create a new market on the interface by clicking the “+” sign above the trading chart and entering the market id of the desired pair. However, exercise caution because some custom market pairings might be outdated; avoid trading on them.

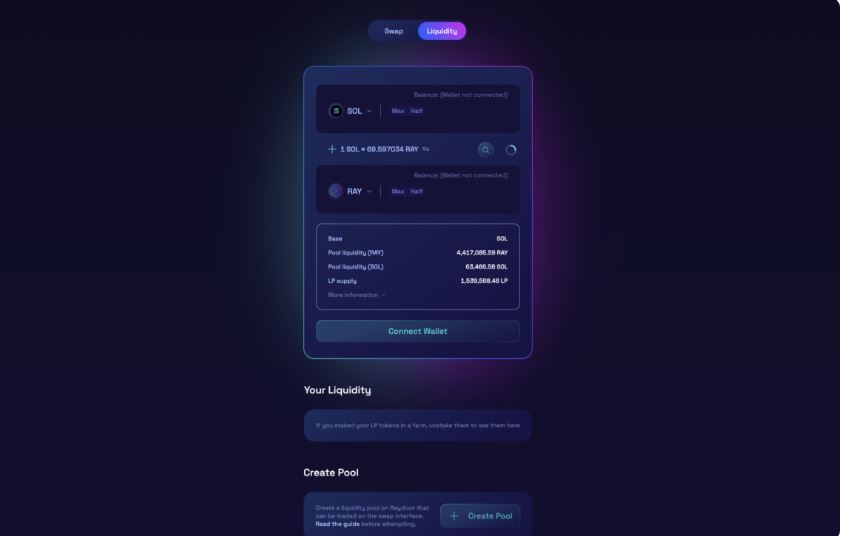

Providing Liquidity

You can give liquidity to a pool if you want to earn rewards with your Solana tokens. With the help of Raydium’s liquidity pools, anyone can provide liquidity by adding assets to the pool and earning transaction fees from swaps made there.

For a pool to have liquidity, two SLP tokens must be distributed equally among you. If you don’t have any, you can use Raydium’s swap/trade feature. Earning Liquidity Provider (LP) tokens for your contributions to a pool effectively represents your pool share. The user can access their tokens at any time using these LP tokens.

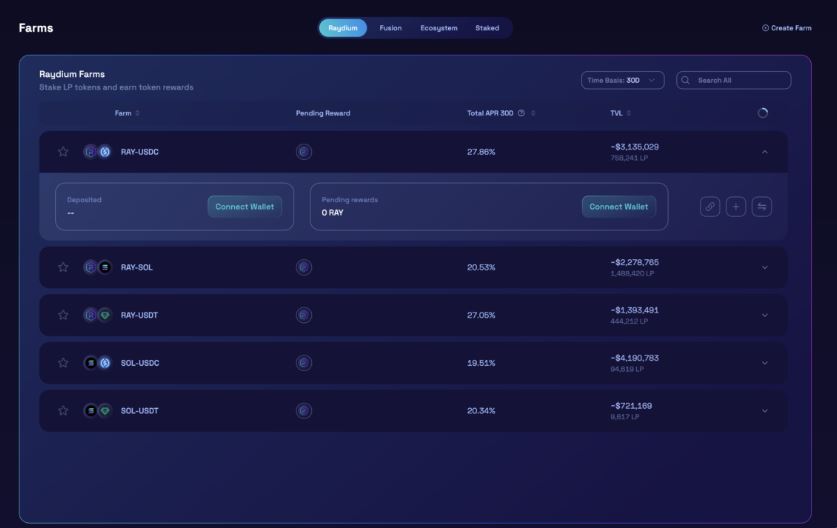

Farming

If you provide liquidity to a pool, you might be able to use Farms to earn extra rewards in addition to trading commissions. To get rewards in various cryptocurrencies, you can stake your liquidity provider (LP) tokens with Raydium Farms.

You can currently earn 28% APY on your deposits of LP tokens. However, keep in mind that as more people add money to the liquidity pool, your share of the total harvest will decrease because the pool will be more evenly distributed among all participants.

Impermanent Loss while providing liquidity carries a significant amount of risk. The main difference between keeping tokens in an AMM and keeping them in a wallet is this. You might end up with more than one token after increasing liquidity, depending on how people trade.

You might come out worse off than if you simply held or staked the tokens you’ve contributed to a pool if one of these tokens is significantly less valuable.

Staking

The RAY token from Raydium can be staked on a single asset. Rates are currently 10% APY, making this a straightforward way to earn extra money. To receive additional RAY prizes, users simply deposit their RAY tokens. The staked Money may be withdrawn whenever desired because the tokens are not locked.

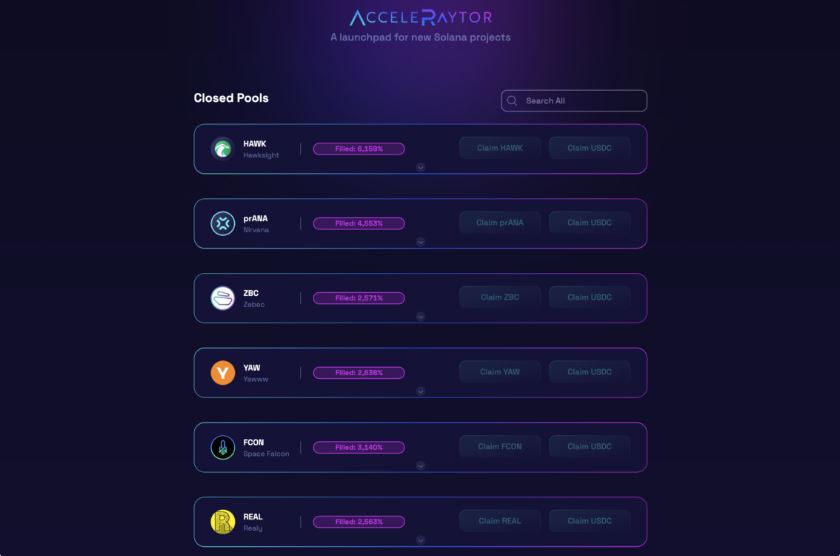

AcceleRaytor

AcceleRaytor, the native launchpad for Raydium, helps projects raise money and generate early liquidity in a decentralized manner. This includes Raydium’s initiatives to guide and promote development in the Solana ecosystem. The majority of the time, this is done by running an ICO on the Raydium platform. The Raydium team curates and evaluates projects to determine whether they are a good fit for the platform’s mission before adding tokens to the Raydium launchpad.

ros and Cons

Pros

- Fast transactions and low fees

- Scalability

- Intuitive trading platform

- Access to Serum DEX order book

Cons

- Integration with only one Serum

- The team behind it hasn’t been fully identified yet