Why is the cryptocurrency market down right now?

As the SEC ordered Paxos to stop issuing Binance USD, the cryptocurrency market is down today as Bitcoin and other cryptocurrencies correct on the news.

The cryptocurrency market is down today as market turbulence rises ahead of the release of the Consumer Price Index (CPI) data, which monitors inflation, on February 14.

The CPI reading from this week, together with tighter regulatory oversight from the Securities and Exchange Commission of the United States (SEC), may result in more declines for Bitcoin (BTC) and the larger crypto market, which is already approaching 3-week lows.

U.S. intensifies its campaign against stablecoin issuers and companies who offer staking as a service.

Investors’ worries regarding legal action against Paxos and Binance as well as the recent SEC ban on centralized staking look to be the main downside catalysts. While some decentralized staking systems might profit from the latest enforcement action, the regulatory climate for cryptocurrencies is still unclear, and market volatility is frequently caused by uncertainty.

Because of numerous misunderstandings or skepticism regarding the actual use case of digital assets, there is a lengthy history of friction between the bitcoin industry and regulators. On how centralized exchanges (CEX) can use customer funds is the subject of the most recent conflict.

The SEC’s chairman, Gary Gensler, issued the following caution:

“If this field has any chance of survival and success, it’s time-tested rules and laws to protect the investing public. Don’t have your hand in the customer’s pocket, using their funds for your own platform.”

On February 9, the SEC began the most current wave of regulatory actions by targeting Kraken’s earn program. The SEC charged Kraken with “failing to register the offer and sale of their crypto asset staking-as-a-service platform,” which the agency alleges qualified as a sale of securities, according to the $30 million settlement release. Kraken also consented to stop running the Earn program in addition to paying the penalties.

In response to the enforcement action, Nexo also decided to discontinue its centralized staking program. While others claim that the staking prohibition is yet another blow to cryptocurrencies, Brian Armstrong, CEO of Coinbase, has promised to challenge the decision in court. The SEC issued further sanctions against Kraken even though not all of its commissioners agreed with the enforcement action.

The SEC informed Paxos, a stablecoin issuer, on February 13 that BUSD is an unregistered securities. The third-largest stablecoin in the cryptocurrency market, BUSD, was ordered by New York officials to stop being issued by Paxos on the same day as the SEC news.

Despite the order against Paxos, Binance has declared their intention to continue supporting BUSD. The potential benefit from arbitrage, hedging, and staking chances, according to US lawyers, complicates the securities case against the BUSD.

Several observers think that until a more broadly accepted set of rules is passed, the mainstreaming of cryptocurrencies cannot take place because the absence of clarity on this issue inhibits growth and innovation within the industry.

Although the Commodities Futures Trading Commission (CFTC) has advocated for more transparent regulation, it is unclear how quickly these reforms will occur. In its plan for cryptocurrencies, the Biden Administration recommends discouraging pension funds from making high-risk investments.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

In the face of a possibly hot CPI report and significant macro headwinds, cryptocurrency values decline

The Dow and S&P 500 remain closely associated with the price of cryptocurrencies. A better-than-expected CPI report in January sparked a rally in the cryptocurrency markets, but ongoing worries about the state of the U.S. and worldwide economies ensure that the CPI print continues to have a significant impact on the markets. Further interest rate increases may be in store if core inflation is higher.

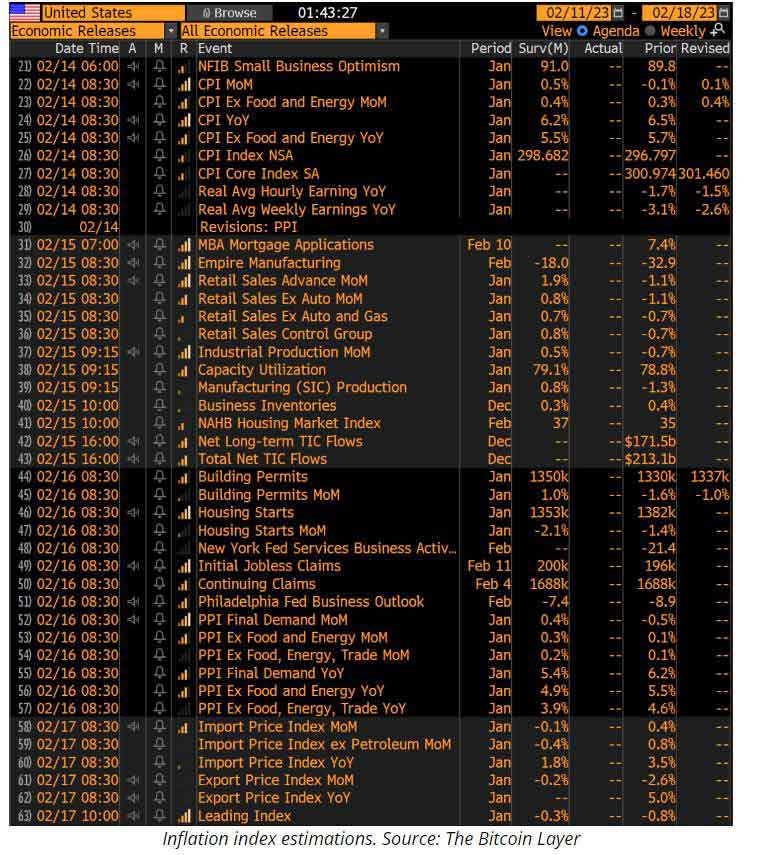

All eyes are on the CPI core statistic, according to Nik Bhatia and Joe Consorti of The Bitcoin Layer.

“The market will be most closely watching the monthly core number, previously 0.3% and expected to rise to 0.4%. Any deviation from these expectations is sure to move markets, and we know that with rates, equities, and Bitcoin all hanging around very important technical areas”

Most big institutions continue to predict that the United States will have a severe recession at some point in 2023, which adds to the delicate feeling around CPI prints.

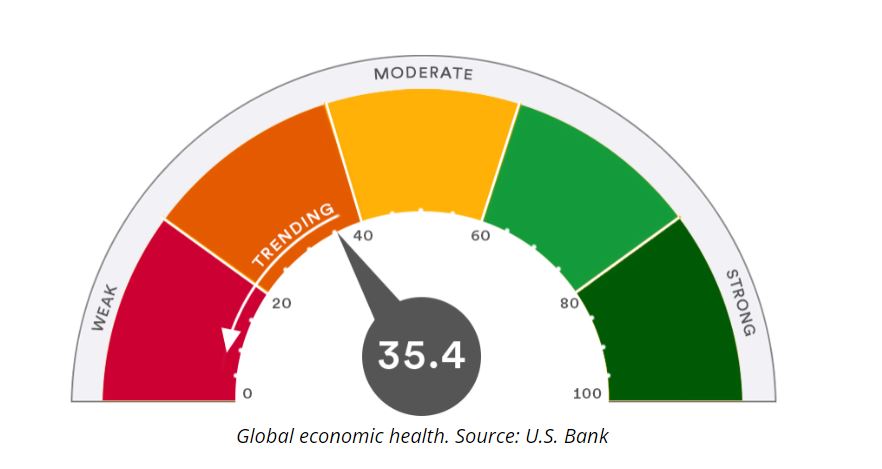

Investor sentiment in the current economy, according to Robert Haworth, Senior Vice President at U.S. Bank, is still weak:

“Consumer confidence remains low but is recovering to start 2023 from the record low in June 2022. The Michigan Consumer Sentiment Index, at 64.9, is well below average pre-pandemic levels, with consumers remaining concerned about inflation. Incomes continue to rise; personal incomes gained 5.8% on a 5% gain in wages in the fourth quarter and disposable personal income (less taxes) rose 6.5%. However, a rising savings rate during the quarter indicates consumers appear cautious.”

Following Bitcoin’s outstanding January performance, traders book profits

With the price of bitcoin reaching $24,000 on January 29, 2023 has gotten off to a fantastic start for bitcoin and the cryptocurrency industry, with 64% of BTC investors making a profit. Even struggling Bitcoin miners experienced significant increase, with sales increasing by 50% to $23 million, indicating a turnaround for the troubled sector.

Although January was the second-best on record for Bitcoin, a price correction in cryptocurrencies may begin due to the volatility brought on by the SEC and macro markets. With gains of 43% and 32% in January for Bitcoin and Ether, respectively, some investors might start locking in profits before the U.S. tax filing season and the CPI report.

Head of markets at Cointelegraph Ray Salmond offered the following analysis of the relationship between the price of bitcoin and the CPI:

“The price action seen in Bitcoin and the wider crypto market reflect traders’ anxiety over the SEC’s action against Binance and ahead of the CPI. In previous instances we’ve seen a bit of risk off maneuvering on the day of CPI. If the CPI report aligns with the expectations of market participants, we’ve seen an extension of the bullish momentum, but in this scenario, traders will look closely at core inflation numbers to gain insight on the potential future size of rate hikes. The recent spate of layoffs in big tech and spun down earnings estimates from brokerages and analysts also raise concerns about the health of the economy.”

Leading cryptocurrency investors predict further sell-offs, while Bitcoin analysts continue to issue cautionary statements about the continuation of the long-term decline. Below $20,000, there is a CME futures “gap,” and some traders predict that at some point in the future, the price of BTC will retrace to this level.

Investors’ appetite for risk is likely to remain low in the interim, so prospective cryptocurrency traders may want to hold off until there are indications that US inflation has peaked or until the Fed indicates that smaller-scale interest rate increases are on the horizon. A more open regulatory roadmap for the cryptocurrency business would also assist to boost confidence in the area.