A Look at Loopring: A Comprehensive Analysis of Loopring’s Benefits, 2023

In this Loopring review, we look at the novel protocol that uses zkRollups technology to create decentralized exchanges with greater scalability and lower commissions than Ethereum. We also discuss staking options and the LRC token, as well as the platform’s advantages and disadvantages.

Introduction

What is Loopring

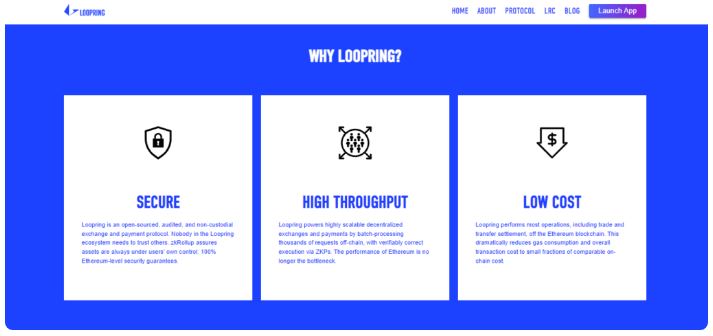

zkRollups, a scalability and privacy technology, is used in the Loopring protocol, which makes it easier to set up decentralized exchanges based on a sidechain. The platform gives developers the tools they need to build DEX and takes the burden of transactions off the Ethereum chain, making it easier to scale and cheaper to charge fees. The network uses smart contracts to verify thousands of Ethereum transactions and charges commissions that are lower than Ethereum’s. With low commissions and the transparency of an open and verifiable protocol, Loopring combines the best features of the centralized exchange market.

Loopring History

The Loopring foundation, a Shanghai, China-based software engineer and entrepreneur, was responsible for developing and managing the Loopring protocol. Wang received his bachelor’s and master’s degrees in computer science from Arizona State University and the University of Science and Technology of China, respectively.

Wang held a number of managerial and senior positions in large technology companies prior to his work on Loopring. He was a senior software engineer and tech lead at Google as well as a lead software engineer at Boston Scientific, a manufacturer of medical devices. He likewise filled in as the ranking executive of designing, search, suggestion, and promotion framework at JD.com, a noticeable Chinese online business monster. Wang co-founded other businesses alongside Loopring, such as Yunrang (Beijing) Information Technology Ltd. and Coinport Technology Ltd., a cryptocurrency services company.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

Loopring Protocol

The Loopring protocol is a second-level scaling protocol for decentralized exchanges (DEX) and payment systems that is schema-independent. It is as of now functional with Ethereum, NEO, and Qtum blockchains and is a fundamental framework supporting the DeFi organization. The platform gives developers the tools they need to build DEX and takes the burden of transactions off the Ethereum chain, making it easier to scale and cheaper to charge fees. It is an automatic token exchange protocol that is open-source and runs on a high-performance, secure, decentralized protocol system. The design of Loopring guarantees defense against distributed attacks, frontal attacks, Sybil attacks, and other forms of fraud.

What Is zkRollups

The hard work of computation and transaction creation is moved outside of the core Ethereum network with the help of zkRollups, a tool for scaling Ethereum. The cryptographic proof-of-concept, on the other hand, maintains security by validating thousands of Ethereum transactions through a smart contract. To put it another way, on the Loopring off-chain network, proof-of-concept transactions are generated by the Ethereum blockchain. As a result, users gain access to a secure, quick, and simple solution.

With these capacities, Loopring can lead 100-200 times a bigger number of exchanges than Ethereum at a lower cost and with higher security than different arrangements. According to the project’s official website, there will be 2,025 transactions processed per second. The security of a blockchain is comparable to that of Ethereum because the data is transmitted there. An “order ring” is used to execute orders in the order book, allowing triangulation between different assets and orders to close a set of transactions. Similar to market makers, the miners of these transactions, known as ring miners, receive a percentage of the transaction.

The ring order system and ring miners of Loopring offer a solution that can carry out more transactions for less money, making it an appealing option for participants in the network to provide liquidity.

How Does Loopring Work?

Miners, who carry out essential tasks, are involved in the protocol that Loopring uses. In exchange for their services, ring miners and ring orders receive a reward because they play a crucial role in executing orders. In contrast, traders reimburse miners through an order margin or fee, with two options:

- Order Reward: As a reward for carrying out an order, traders can set a maximum number of LRC tokens that can be given to the miner.

- Margin Split: Traders can specify the necessary margin for a particular order, allowing miners to select their preferred commission and margin.

LRC Token

The native platform token Loopring (LRC) was launched in August 2017 as part of an Ethereum (ETH) initial coin offering (ICO) that raised $45 million. The Loopring protocol, an open-source, decentralized exchange that enables users to trade cryptocurrencies without requiring a centralized authority, was developed with the assistance of the funds.

LRC is an Ethereum-based ERC20 token that is used to pay commissions on the network. Sidechain node operators who carry out essential tasks like executing orders and verifying transactions benefit financially from it. By involving LRC tokens for the purpose of installment, Loopring boosts clients to partake in the organization and gives a protected and dependable stage for exchanging.

Marking pools are another significant use case for LRC tokens. Marking members should enter their tokens into the pools, which get 70% of the convention’s bonus appropriation. To fit the bill for this prize framework, clients should wager for something like 90 days to accept their corresponding portion of the commission. Users are encouraged to hold onto their tokens for longer as a result, which ultimately benefits the stability and security of the network as a whole.

At first, the conveyance of convention expenses not entirely settled by the Loopring DAO, however it is configurable. The following will be the initial distribution of the protocol fees:

Liquidity providers (LPs) who supply liquidity to Loopring orderbooks and AMMs will receive 80% of the fees. Liquidity providers that make use of LRC will receive at least fifty percent of this sum. Insurers that contribute capital to the safety insurance fund will receive 10% of the fees. The Loopring DAO, which will decide how to use the funds, will receive 10% of the fees. The funds could be put to use for things like buybacks and burns, safeguards against temporary loss, additional liquidity incentives, grants, and other things.

Additionally, the Loopring protocol’s technology requires the creation of a brand-new LRx token for each integrated chain, where “x” denotes the blockchain. Users are now able to trade assets across multiple chains thanks to this capability of interoperability between various blockchains.

A proof-of-work (PoW) algorithm is used by Loopring to verify and generate new network blocks. For their efforts, miners are rewarded with Loopring tokens, which contributes to the integrity and security of the network.

By eliminating some of the wallet fees, the LRC burn rate makes token scarcity worse. Additionally, it eliminates some of the miners’ fees. On the Loopring exchange, bidders betting on Loopring cryptocurrency (LRC) are entitled to lower transaction fees. This mechanism contributes to the long-term sustainability of the network and the stability of LRC’s value.

How to Stake LRC Tokens?

Users of Loopring (LRC) can stake in one of three ways to participate in the governance of the network and earn rewards:

- Global Pool Betting Protocol: Users can stake LRC tokens to earn 70 percent of the fees charged by the Loopring protocol, and this option is open to everyone. No base sum is expected to partake, yet tokens should be locked for no less than 90 days to fit the bill for the award framework.

- The owner’s wager on the exchange: Owners of Loopring exchanges can take advantage of this staking option because they are required to wager on LRC tokens in order to safeguard the DEX’s reputation and security. This kind of staking requires a minimum of 250,000 LRC, but it can go as high as 1 million LRC, depending on the kind of exchange. For the duration of the exchange protocol, the LRC tokens must be kept under lock and key.

- reduced exchange commission: On the Loopring exchange, traders have access to this staking option. The trade proprietor pays the convention expenses for orders, however merchants should pay exchange charges for each exchange. The fee for a transaction can be paid by traders using the same token as the transaction, and if they bet on LRC tokens, the fee can be reduced.

Users can select the staking method that best meets their requirements and preferences because each option comes with its own set of requirements and rewards. Users can earn rewards by staking LRC tokens, which also helps secure the network and encourages its expansion and development.

Loopring (LRC) is an ERC-20 token, and that implies that LRC can be put away in any digital money wallet that upholds ETH and ERC-20 tokens. There are a variety of cryptocurrency wallets on the market, including desktop, online, mobile, and hardware wallets.

Guarda is a great option among the many wallets for storing, purchasing, and selling LRC tokens. Utilizing the Guarda wallet guarantees a user-friendly, dependable, and secure storage option. In addition, LRC holders will find it simple to manage their tokens because Guarda wallet is accessible on a variety of platforms, including browsers, Android, iOS, Windows, and Mac, as well as Windows.